“So that’s how you do that!” My article on handling retainers, “Would You Pass a Trust Account Audit?,” generated a lot of inquiries and ah-hah moments. So, I’m following up with more tips on handling trust accounting transactions, focusing on settlements.

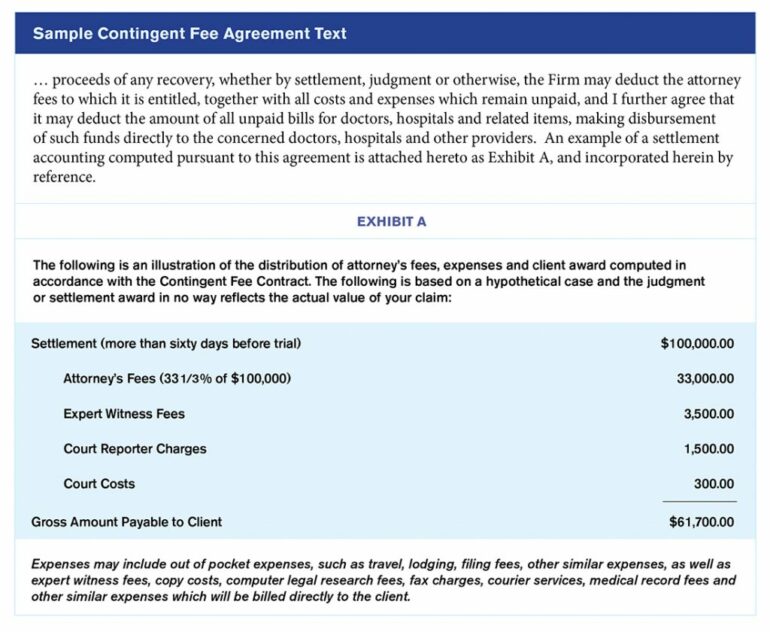

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying if any.

As an example, below is a sample of text that may be used in a contingent fee agreement.

Certain types of funds require special handling, and settlement funds fall into this category. Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account. Depositing into the trust account serves as notice to the world that this money is not for you to use for regular business operations.

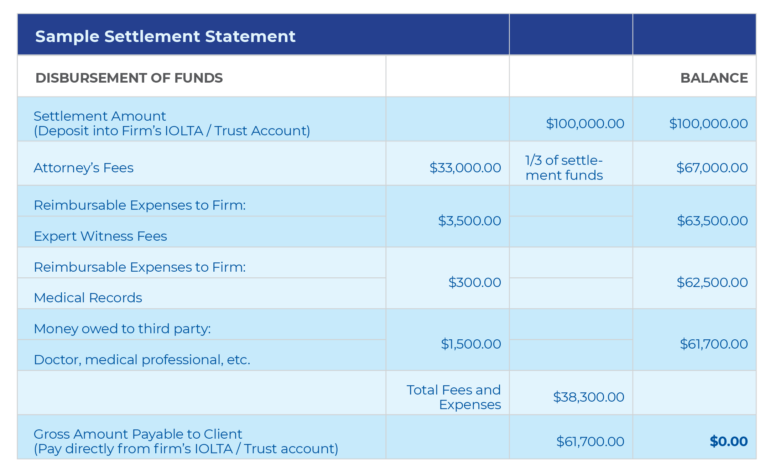

Here is an example illustrating a basic settlement statement.

You always want to review and follow your state’s particular ethics guidelines and procedures, but here is a general checklist, and some best practices, for handling settlements.

It can’t hurt to emphasize at the start of this checklist that you should never disburse funds until you have faithfully recorded and deposited the check — and made certain it has cleared. That said, here are basic procedures:

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

Your practice management system or accounting software should be able to produce a report that lists all expenses incurred and paid by the firm on behalf of the client during the representation. Include a copy of this report with the settlement statement.

Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger. First, though, before your firm can be paid from the settlement, you need to prepare an invoice to the client for your fees and expenses, and then receive payment for it. That way, you can properly account for the revenue and expense recovery.

In your practice management system or accounting system, do this:

Write other checks, completing the settlement statement:

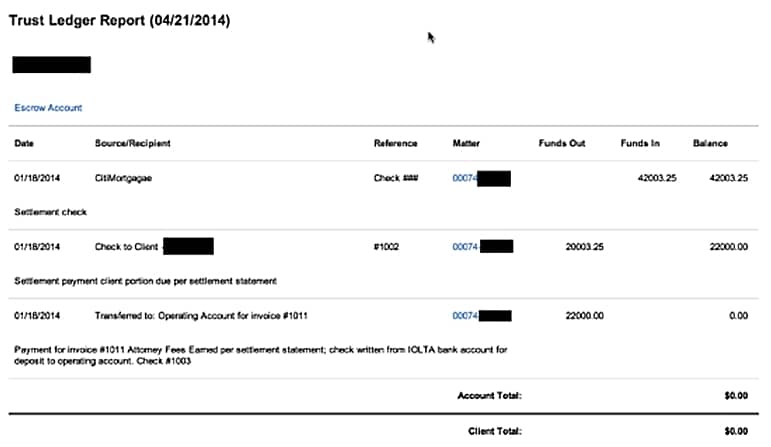

Next, run a client trust ledger report in your accounting system, showing all the transactions (deposits and checks written). The account balance should equal $0.00.

Note: When writing checks from settlement funds, be sure to go back to the settlement statement to record each check number there, then save a copy of it in the client’s file. (Ideally, your client files are electronic. Haven’t moved to paperless yet? Now is a good time to start.) This provides an additional audit trail.

Lastly, the client should be sent the following items, via certified mail or delivered in person:

Now you should scan and save all of your final documentation in the client file.

Tip: A word of caution when the settlement check comes and you’re sitting with your client across the table from you. Don’t let the client persuade you to write their check for their portion of the settlement on the spot. Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

With this checklist to follow, you can rest easier about being ethically compliant when handling client settlement funds.

Don’t miss out on our daily practice management tips. Subscribe to Attorney at Work’s free newsletter here >